Crude oil daily: new crown epidemic continues to file, fuel demand prices fell on Thursday

Time:2020-07-27 10:48:18

views:

Oil prices closed down on Thursday (July 23): US WTI crude oil September futures fell by US $0.83 to US $41.07/barrel, down 2%. Earlier, it hit an intraday low of US $40.83/barrel. Although WTI crude oil closed lower, it still rose more than 1% this week and nearly 5% this month; Brent crude oil futures for September fell by $0.98 to $43.31/barrel, or 2.2%.

Favorable factors of crude oil price Fundamentals:

On Wednesday, Beijing time, data released by the American Petroleum Association (API) showed that gasoline inventory decreased by 2.019 million barrels in the week ending July 17, compared with an expected decrease of 1175000 barrels; API refined oil inventory decreased by 1357000 barrels, with an expected decrease of 55000 barrels; and crude oil imports decreased by 825000 barrels / day last week.

Dao Ming Securities pointed out that in view of the fact that the output of the United States has not yet declined further, the growth rate of demand in the United States may improve in the next few weeks, and the U.S. government has begun to seriously encourage the use of masks and other measures to limit the spread of the new coronavirus. Oil prices are expected to gradually rise back to the top of the trading range, and are expected to trade in the range of $38 to $42 in the short term, and then rise further 44 dollars.

According to the research on bulk commodities of Barclays, it is still optimistic about next year's oil price, and forecasts the price of cloth oil and US oil to be 53 US dollars / barrel and 50 US dollars / barrel respectively. If the recovery in demand slows down further, especially in the United States, oil prices are expected to correct in the short term. It is expected that the oil market surplus in 2020 will average 2.5 million barrels / day, compared with the previous forecast of 3.5 million barrels / day.

Oil price bulls also hailed the sharp decline in Saudi Arabia's oil exports in May. Saudi oil exports fell 65% this month, according to official data. It is worth noting that Saudi Arabia is OPEC's largest oil exporter. The share of Saudi Crude oil exports in total exports fell to 65.4%, compared with 78.6% in the same period last year, according to official data. Saudi oil exports fell 65.0% to 44.277 billion Riyals in May 2020. In May 2020, Saudi Arabia's total exports to China totaled 7.705 billion Riyals. China was the main destination of Saudi Arabia's exports. Saudi Arabia's non oil exports decreased by 31.9% to 12.64 billion Riyals on a year-on-year basis.

Negative factors of crude oil price Fundamentals:

According to data released by the US Energy Information Administration (EIA) on Wednesday night, as of July 17, EIA crude oil inventory increased by 4.892 million barrels to 536.6 million barrels, down from 7.493 million barrels, and the expected value decreased by 2.088 million barrels; domestic crude oil production in the United States recorded an increase this week after being flat for three consecutive weeks; and Cushing oil inventory in Oklahoma increased for three consecutive weeks Long.

API crude oil inventories rose 7.544 million barrels to 531 million barrels in the week ended July 17, Beijing time on Wednesday, compared with an expected decrease of 1.95 million barrels from 8.322 million barrels. Cushing crude oil inventory increased by 716000 barrels, higher than 548000 barrels. After the API data was released, the United States and cloth oil fell slightly in the short term.

Concerns about the second wave of the U.S. epidemic have curbed a rebound in oil prices. Novel coronavirus pneumonia confirmed novel coronavirus pneumonia cases in July 22nd, according to the JohnsHopkinsUniversity data. 279 thousand and 700 cases of new confirmed pneumonia cases were reported in July 22nd, including 71 thousand and 700 new confirmed cases of pneumonia in the United States. Data from New York State and California reflect a completely different epidemic situation on the East and west coasts of the United States. On the same day, 705 new cases were reported in New York State, 94% lower than the peak in April, while 12807 new infections were reported in California, a one-day high in the state. Affected by this, analysts are still worried about the U.S. economic outlook.

ANZ said novel coronavirus pneumonia cases are often used in large quantities, but the surge in new crown pneumonia cases has hampered the recovery of the usual demand in the US during the summer rush hour.

Dow Ming Securities said that the slowdown in demand may lead to lower US oil futures prices, but will eventually rise to around us $44. The US EIA crude oil inventory increased by 4.892 million barrels in the week ending July 17, and the market expected a decline of 589000 barrels. In addition, the implied demand for crude oil dropped by a disappointing 1.3 million barrels / day. Given OPEC's commitment to increase supply to meet growing demand, the spread of the new crown epidemic in some parts of the United States may lead to a decline in demand and an increase in inventories, and the price of US crude oil futures is likely to decline in the short term.

Related news

-

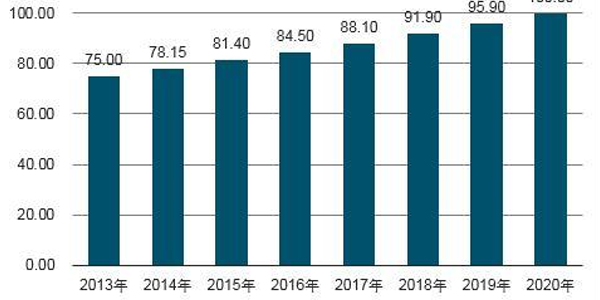

Review of China's crude oil market and prospects for 2020

-

Heavy weight! CNPC and Sinopec official announcement: pipeline related major assets will be sold to national pipeline network

-

Base oil Morning Post: the market price of class I and II base oil continued to decline steadily

-

Why should antioxidant and anti-corrosion agent be added into lubricating oil?